When it comes to Telemedicine, the potential benefits to both employers and employees are substantial. Time and money savings, improved health and wellness, boosted happiness and productivity. The list goes on. But, all those wonderful benefits are only that… potential.

The fact is that until Telemedicine is used, it doesn’t benefit anyone. It’s a super-car sitting in a garage, an unopened bottle of incredible wine, an unused gift card to your favorite store. Sure, we all know these things will be amazing, but not until you use them do you realize their true potential. The same can be said for Telemedicine.

One of the main reasons employers offer Telemedicine is its ability to reduce their medical expenses. And it can! By replacing expensive visits to traditional care outlets with something as inexpensive and convenient as a phone call, there is significant money savings.

As a matter of fact, Teladoc commissioned a study form Harvard where they examined a 30-day ‘episode of care’ for people who used Telemedicine versus people who didn’t. They found that on average, there is a $515 savings every time someone forgoes traditional care and opts to use Telemedicine instead.

That’s a lot of money!

For a self-funded plan, that $515 could go right back into the company’s bank account, real money that can be saved by using Telemedicine. For fully-insured plans, a reduction in claims will lower your renewals, not to mention all the other benefits that come from Telemedicine.

Let’s take a look at how that plays out when looking at our plan versus a carrier plan, and we’ll see exactly what we mean when we say that you’re paying too much for your free Telemedicine plan.

Let’s take a look at how that plays out when looking at our plan versus a carrier plan, and we’ll see exactly what we mean when we say that you’re paying too much for your free Telemedicine plan.

With the carrier plans, Telemedicine is included, or ‘baked in’ to the plan itself, so there is no line item cost to the client for its services. Typically, these plans have a $5 to $50 copay and come with very little communication to the member, or support for the client. Left to their own support and communication, most companies using a carrier plan will see less than 5% utilization, more like 3%.

Compare that with Call A Doctor Plus

With our extensive account support, along with our marketing and communications strategy and our $0 copay plan design, we achieved 50.36% utilization in 2016 across our entire book of business.

That is between 10 and 20 times more than the carrier plans!

Although the impact of such high utilization is multi-faceted, when looking at this strictly from an ROI basis, the numbers are quite compelling, even when taking into account our PFPM rate. Let’s use a group of 250 as an example at $6.50 PFPM compared to the carrier included plan.

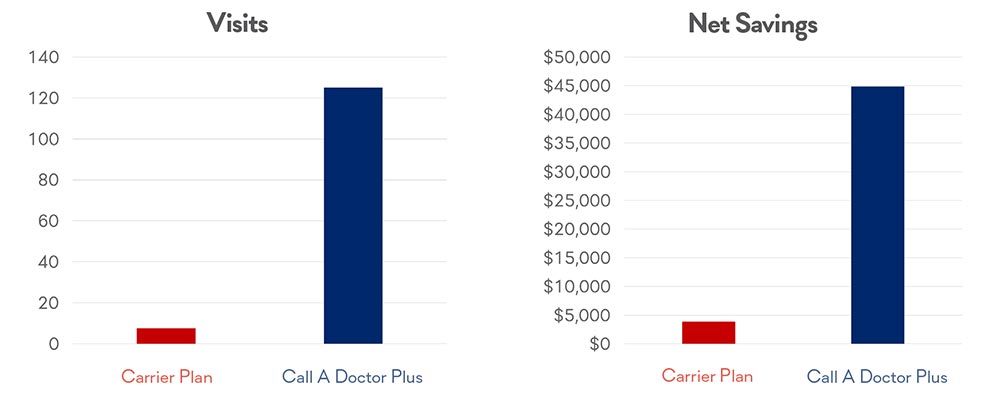

With the carrier plan, the cost of the program is included in the monthly premium, compared to our program, which will cost the employer $19,500 per year. However, the total savings of our program comes in at $64,375, compared to the Carrier plan at $3,862.50.

Net savings result? An astounding $44,875 to $3,862.50. Over 11 times more savings with our plan than with the Carrier plan!

As you can see, there are significant gains in both visit count and net return to the client.

Hopefully, it should be clear that utilization is a significant driver of not only interactions, but also net savings to your organization.

To learn more about Call A Doctor Plus and why our utilization is so much higher, please reach out and let us know how we can help you!